Quantitative Analysis(APD pt.1)

Quantitative analysis (Ticker: APD)

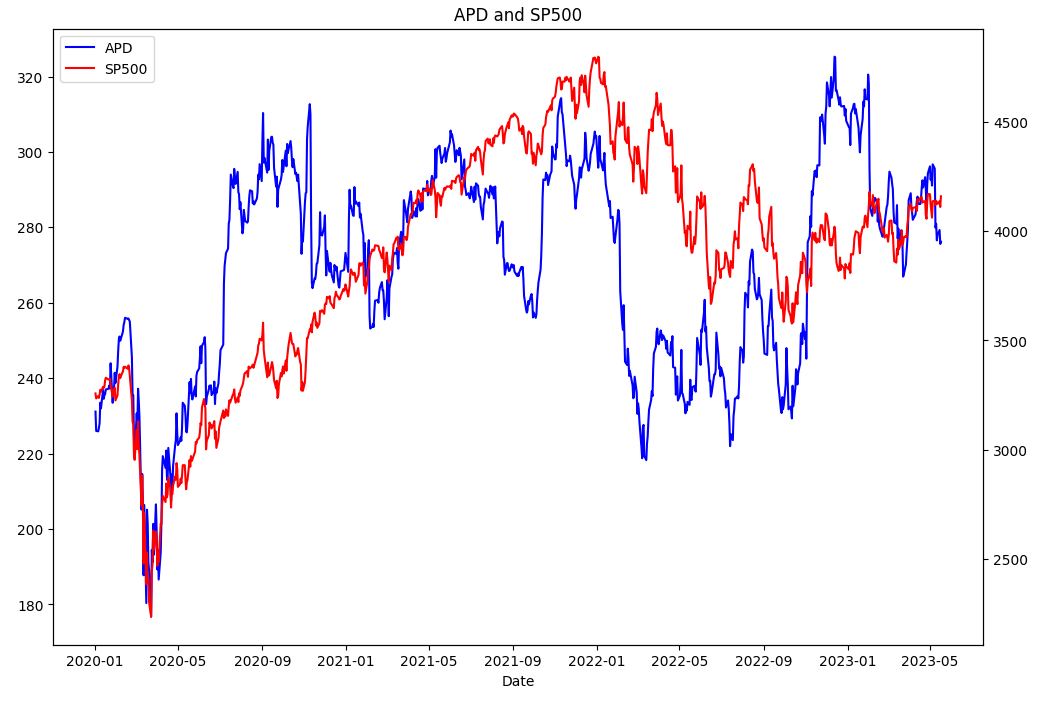

APD compares S&P500 index

Import all libraries needed

pip install finance-datareader openai pyfolio finvizfinance yfinance

import pandas as pd

import FinanceDataReader as fdr

import matplotlib.pyplot as plt

import yfinance as yf

import pyfolio as pf

from finvizfinance.screener.overview import Overview

from finvizfinance.insider import Insider

from finvizfinance.news import News

from finvizfinance.quote import finvizfinance

IPython_default = plt.rcParams.copy()

plt.style.use('tableau-colorblind10')

Pull APD and S&P500 data to compare with the specific date.

I pulled the data from 2020-01-01 to 2023-05-18.

apd = fdr.DataReader('apd', '2020-01-01', '2023-05-18')

sp500 = fdr.DataReader('us500', '2020-01-01', '2023-05-18')

fig, ax = plt.subplots(figsize=(12,8))

l1 = ax.plot(apd[['Close']], color='blue', label='APD')

ax.set_title('APD and SP500')

ax.set_xlabel('Date')

ax2 = ax.twinx()

l2 = ax2.plot(sp500[['Close']], color='red', label='SP500')

ax.grid

ax.legend(handles=l1+l2, loc=2)

plt.show()

The chart shows that APD’s price is not S&P500 index, it has more volatility.

returns = (apd[['Close']].pct_change()+1).product()-1

returns

Close 0.194947 dtype: float64

df = pd.DataFrame()

df['SP500'] = sp500.loc['2020-01-01':'2023-05-19', 'Close']

df['APD'] = apd.loc['2020-01-01':'2023-05-19', 'Close']

df.head()

SP500 APD

Date

2020-01-02 3257.850098 231.139999

2020-01-03 3234.850098 226.000000

2020-01-06 3246.280029 225.899994

2020-01-07 3237.179932 226.860001

2020-01-08 3253.050049 228.089996

changes = df.pct_change()

corr = changes.corr()

corr.head()

SP500 APD

SP500 1.000000 0.721876

APD 0.721876 1.000000

plt.figure(figsize=(16,8))

plt.grid(False)

plt.imshow(corr, cmap='hot', interpolation='none')

plt.colorbar()

plt.xticks(range(len(corr)), corr.columns, rotation=90)

plt.yticks(range(len(corr)), corr.columns)

plt.show()

<Figure size 1600x800 with 2 Axes>

msdf = pd.DataFrame()

msdf['Mean'] = changes.mean()

msdf['Standard Deviation'] = changes.std()

msdf

Mean Standard Deviation

SP500 0.000408 0.015461

APD 0.000410 0.019988

# 2020-2023 returns and risk

plt.figure(figsize=(16,8))

plt.scatter(changes.mean(), changes.std())

plt.xlabel('returns')

plt.ylabel('risk')

plt.xlim(0.0003,0.0005)

plt.ylim(0,0.0)

for label, x, y in zip(changes.columns, changes.mean(), changes.std()):

plt.annotate(label, xy=(x, y), xytext=(30, -30),

textcoords = 'offset points',

ha = 'right', va = 'bottom',

bbox = dict(boxstyle = 'round,pad=0.5', fc = 'green', alpha = 0.5),

arrowprops = dict(arrowstyle = '->', connectionstyle = 'arc3, rad=0'))

<Figure size 1600x800 with 1 Axes>

tickers = ['APD','^GSPC']

# df_close = fdr.DataReader('TIO')

# df_close = df_close[['Close']]

df_close = yf.download(tickers=tickers,

start='2020-01-01',

interval='1d',

auto_adjust=True

)['Close']

weights = [1,0]

print('Start date of each stock')

print('-'*25)

for ticker in tickers:

print(f"{ticker}: {df_close[[ticker]].dropna().iloc[0].name.strftime('%Y-%m-%d')}")

print('-'*25)

[ 0% ] [*********************100%***********************] 2 of 2 completed Start date of each stock ------------------------- APD: 2020-01-02 ^GSPC: 2020-01-02 -------------------------

cdf = df_close.dropna()

target_end_date = pd.to_datetime('2023-05-19')

time_period = cdf.index.to_frame()

trading_period = time_period.resample('BM').last().iloc[::12, :].rename(columns={'Date':'start_date'})

trading_period = trading_period.assign(end_date=trading_period.start_date.shift(-1).fillna(time_period.iloc[-1].name)) # 'time_period.iloc[-1].name' up to date instead of target date

trading_period

start_date end_date

Date

2020-01-31 2020-01-31 2021-01-29

2021-01-29 2021-01-29 2022-01-31

2022-01-31 2022-01-31 2023-01-31

2023-01-31 2023-01-31 2023-05-19

import numpy as np

def get_mdd(cdf_price, start, end, col):

cdf_price = cdf_price[start:end].copy()

return ((cdf_price[col]-cdf_price[col].cummax())/cdf_price[col].cummax()).cummin()

def get_pf_returns(cdf_price, tickers, start, end, weights=weights, use_signal=None):

# if weights is None:

# weights = [1/len(tickers) for _ in range(len(tickers))]

# calculate daily returns

ret_dict = {f"{ticker}"+"_RET": cdf_price[ticker].pct_change().fillna(0) for ticker in tickers}

cdf_price = cdf_price.assign(**ret_dict)

# select data within the trading period

df_trade = cdf_price.loc[start:end].copy()

# assign 0 for the first row. returns can't be calculated on the first trading day

df_trade.loc[start, :] = 0

# calculate daily portfolio returns

df_trade = df_trade.assign(PF_RET=df_trade[ret_dict.keys()].dot(weights))

# calculate cumulative returns within the trading period

cumret_dict = {f"{col}_CUMRET": (1+df_trade[f"{col}_RET"]).cumprod() for col in tickers}

port_cumret = np.cumprod(1+df_trade[ret_dict.keys()].dot(weights))

df_trade = df_trade.assign(PF_RET=df_trade[ret_dict.keys()].dot(weights), **cumret_dict,

PF_CUMRET=port_cumret)

cumret_cols = [col for col in df_trade.columns if 'CUMRET' in col]

# calculate MDD within the trading period

mdd_dict = {col.split('_')[0] +'_MDD': get_mdd(cdf_price = df_trade,

start=df_trade.index[0],

end=df_trade.index[-1],

col=col)

for col in cumret_cols}

df_trade = df_trade.assign(**mdd_dict)

return df_trade

df_res = pd.DataFrame()

for i in range(len(trading_period)):

df_trade = get_pf_returns(cdf_price = cdf,

tickers=tickers,

start=trading_period.iloc[i].start_date,

end=trading_period.iloc[i].end_date)

df_res=pd.concat([df_res, df_trade], axis=0)

df_res = df_res.reset_index().drop_duplicates(['Date'], keep='first').set_index('Date')

df_res

APD ^GSPC APD_RET ^GSPC_RET PF_RET \

Date

2020-01-31 0.000000 0.000000 0.000000 0.000000 0.000000

2020-02-03 225.553452 3248.919922 0.018014 0.007255 0.018014

2020-02-04 229.340332 3297.590088 0.016789 0.014980 0.016789

2020-02-05 232.301193 3334.689941 0.012910 0.011251 0.012910

2020-02-06 233.025162 3345.780029 0.003117 0.003326 0.003117

... ... ... ... ... ...

2023-05-15 279.290009 4136.279785 0.004640 0.002958 0.004640

2023-05-16 275.589996 4109.899902 -0.013248 -0.006378 -0.013248

2023-05-17 276.200012 4158.770020 0.002213 0.011891 0.002213

2023-05-18 275.450012 4198.049805 -0.002715 0.009445 -0.002715

2023-05-19 278.910004 4191.979980 0.012561 -0.001446 0.012561

APD_CUMRET ^GSPC_CUMRET PF_CUMRET APD_MDD ^GSPC_MDD PF_MDD

Date

2020-01-31 1.000000 1.000000 1.000000 0.00000 0.000000 0.00000

2020-02-03 1.018014 1.007255 1.018014 0.00000 0.000000 0.00000

2020-02-04 1.035105 1.022344 1.035105 0.00000 0.000000 0.00000

2020-02-05 1.048469 1.033846 1.048469 0.00000 0.000000 0.00000

2020-02-06 1.051736 1.037284 1.051736 0.00000 0.000000 0.00000

... ... ... ... ... ... ...

2023-05-15 0.876878 1.014640 0.876878 -0.16714 -0.077516 -0.16714

2023-05-16 0.865262 1.008169 0.865262 -0.16714 -0.077516 -0.16714

2023-05-17 0.867177 1.020156 0.867177 -0.16714 -0.077516 -0.16714

2023-05-18 0.864822 1.029792 0.864822 -0.16714 -0.077516 -0.16714

2023-05-19 0.875685 1.028303 0.875685 -0.16714 -0.077516 -0.16714

[832 rows x 11 columns]

plt.rcParams.update(IPython_default);

plt.style.use('_mpl-gallery')

colors =['blue','red','green']

(1+df_res[['APD_RET', '^GSPC_RET']]).cumprod().plot(figsize=(12,8), linewidth=1, color=colors)

plt.title('Cumulative returns')

plt.tight_layout();

<Figure size 1200x800 with 1 Axes>

pf.show_perf_stats(returns=df_res.PF_RET)

/usr/local/lib/python3.10/dist-packages/pyfolio/timeseries.py:724: FutureWarning: The default dtype for empty Series will be 'object' instead of 'float64' in a future version. Specify a dtype explicitly to silence this warning. stats = pd.Series() /usr/local/lib/python3.10/dist-packages/pyfolio/plotting.py:648: FutureWarning: iteritems is deprecated and will be removed in a future version. Use .items instead. for stat, value in perf_stats[column].iteritems():

</pre>