Big Shorts in South Korea

1. Introduction

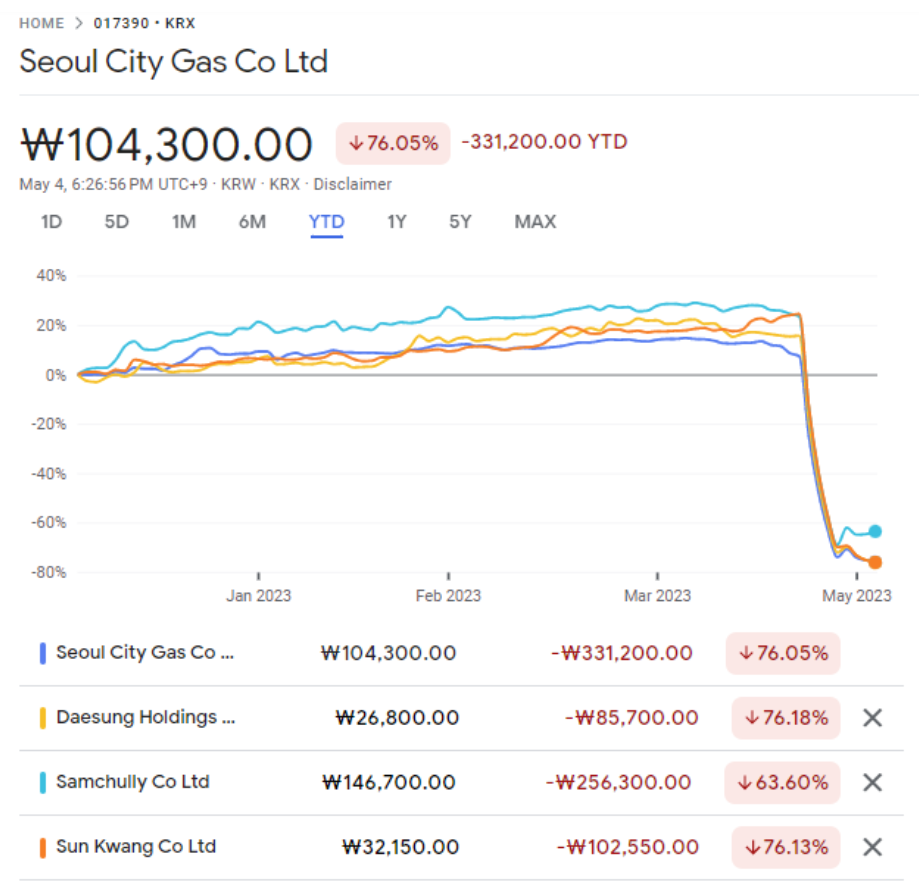

On Monday, April 24, 2023, financial authorities and prosecutors launched a full-scale investigation into suspected stock price manipulation of eight stocks whose share prices recently plummeted due to a large volume of selling through SG Securities, a foreign securities company.

The reason for the decline is that those who had been pushing up the stock prices were selling off in a hurry in response to the financial authorities’ investigation. Hundreds of investors are said to have been affected by the lower price.

2. List of stocks

- Seoul City Gas Co

- Daesung Holdings

- Samchully Co Ltd

- Sun Kwang Co Ltd

- Sebang Col Ltd

- DAOL Financial Group

- Harim Co Ltd

- DAOU Data Corp

- CJ

3. How the stock price was manipulated and how it plummeted

According to the media and interviews with officials, it seems that the stock price was manipulated using a combination of pyramid schemes and proprietary trading methods.

There are two groups of people involved: the power group that actually manipulated the stock price and the investors who provided the money. The investor group provides the power group with money to manipulate the stock price and recruits new investors. For bringing in new people, the power group would share in the profits on top of the profits from the stock, in a typical pyramid scheme.

The money was used to buy and sell shares amongst themselves, making it look like the stock was doing well and attracting apes. Even federal pension funds have been found to have lost at least tens of billions of dollars buying into the scheme. Since pension funds have a tendency to mechanically buy stocks that are part of certain indices, they were victimized by the manipulation.

Starting in 2020, the manipulators opened mobile phones in the names of investors to buy these stocks, and some investors were given laptops and used remote programs to make proxy investments. Naturally, the manipulators targested groups with money, as it is impossible to manipulate stock prices with little money, for example, businessman, doctors and celebrities.

3.1. Pyramid scheme

-

The suspects bought the stocks in this case about three years ago, using their offshore accounts to disguise themselves as foreigners. The reason why they did not raise the stock price in a short period of time after the purchase was that if they did, they would be investigated by the Financial Supervisory Service for stock price manipulation.

-

They are believed to have used contracts for difference (CFDs), which are often referred to as options trading or leveraged trading.# CFDs are instruments that invest in the price of a stock, and in very simple terms, they allow you to verify your creditworthiness - your annual income and net worth - and then use that creditworthiness to buy a $9 stock with $3. Then, when the $9 stock is full (up 10%), I can earn $10 as if I had invested $3. From the perspective of the powers that be, this is a “high-risk, high-reward” technique that allows them to make a quick buck with relatively little money. CFDs also have the disadvantage that it is difficult to pinpoint who trades and how much, so it seems that they have been able to use this feature to avoid detection. However, not everyone seems to have opened a CFD account.

-

Investors include high-income earners such as doctors and celebrities. The reason for this is twofold: first, large inflows of money make it easier to manipulate stock prices, and second, brokerage firms only open contracts for difference to high-income earners. In addition, the company has introduced a pyramid scheme, in which those who bring in new investors get a share of the profits of the new investors. As of the 27th, there are more than 1,600 investors and the amount of money involved is said to be 800 billion korean won($0.8B).

-

As the stock price continued to rise, conflicts arose within the factions, with some groups making large sums of money and others making little, until someone unhappy with the disparity blew the whistle on the scheme to the media, and the price manipulation was exposed.

-

On April 24, the “disgruntled” faction dumped all their shares, and the faction tried to buy them back with their own money to prevent a crash, but investors hit the sell button en masse, causing the stock price to drop.

-

In this case, those who hold the stock have no choice but to throw it away, regardless of whether they are related to the manipulators or not. There is also a view that the stock fell due to countertrading due to insufficient capital due to CFD trading.

-

Therefore, the only people who benefited in this case were those who were “disgruntled” and sold everything on April 24th, and those who cashed out early, while those who didn’t cash out at the highs, investors, and the ants who were on the sidelines all suffered financially.